Sustainable Investing in South Africa: Aligning Wealth with Values

In the evolving landscape of South African finance, a new paradigm is emerging: sustainable and ethical investing. This approach not only promises financial returns but also aligns wealth creation with social responsibility, offering a path to a more balanced and prosperous future for all.

The Rise of Conscious Capital

As South Africans increasingly seek to make a positive impact with their investments, the concept of sustainable investing has gained significant traction. This approach considers environmental, social, and governance (ESG) factors alongside financial returns, creating a holistic view of investment value.

Reflection Point

How do your investment choices reflect your personal values and vision for South Africa's future?

Opportunities in the South African Market

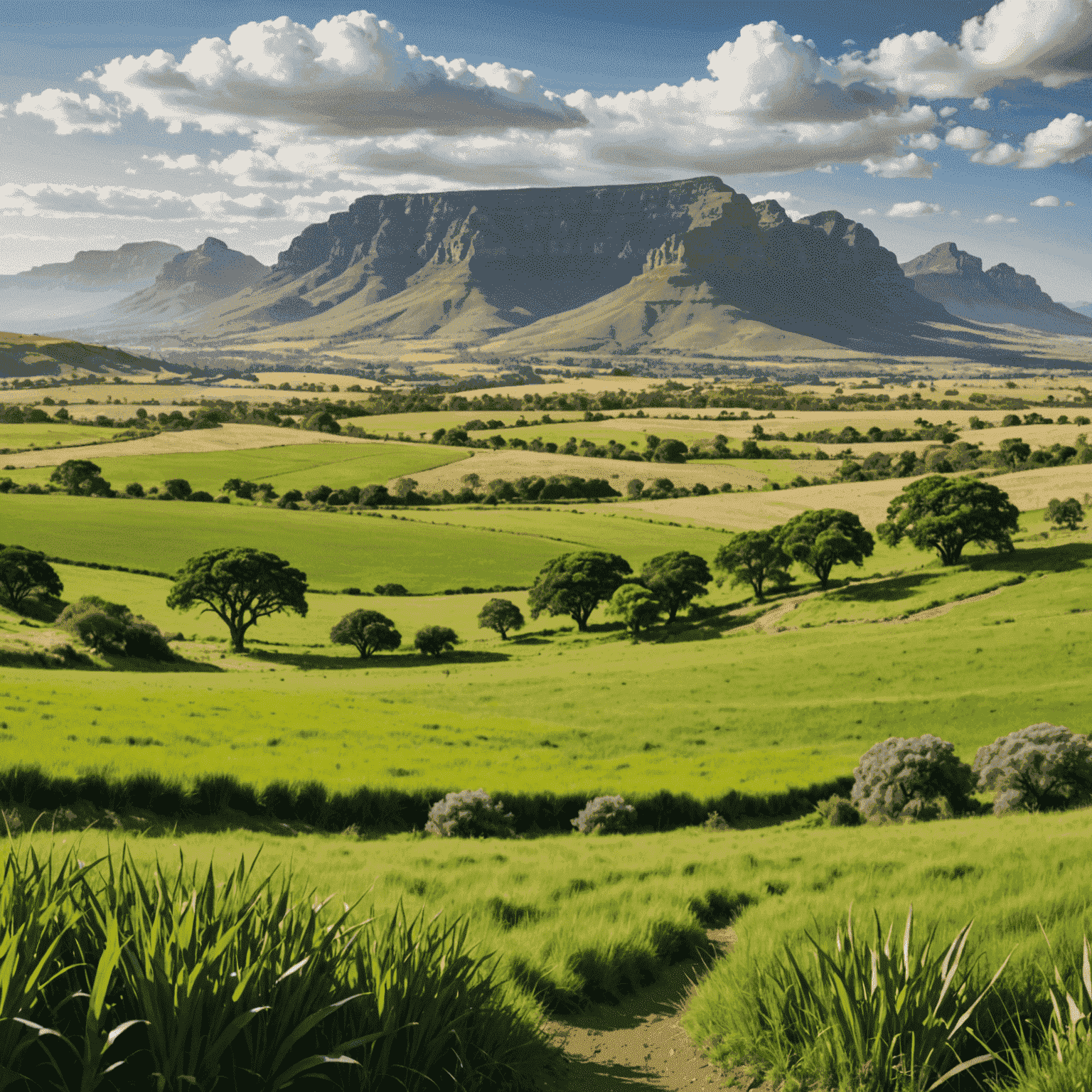

The South African market offers a unique landscape for sustainable investing, with opportunities spanning renewable energy, sustainable agriculture, and inclusive financial services. These sectors not only promise growth but also address pressing social and environmental challenges facing the nation.

- Renewable Energy: Investing in solar and wind projects to address energy security

- Sustainable Agriculture: Supporting initiatives that promote food security and environmental stewardship

- Inclusive Finance: Backing fintech solutions that expand access to financial services for underserved communities

Balancing Returns and Impact

While the primary goal of investing is financial return, sustainable investing introduces a new dimension: measurable positive impact. This dual focus requires a shift in mindset, encouraging investors to consider long-term value creation beyond immediate profits.

Journaling Prompt

Describe your ideal investment portfolio that balances financial growth with positive societal impact. What sectors or initiatives would you prioritize?

Overcoming Challenges

Embracing sustainable investing in South Africa comes with its unique set of challenges, including:

- Limited awareness and understanding of ESG factors

- Perceived trade-offs between financial returns and social impact

- Need for standardized reporting and measurement of sustainability metrics

However, these challenges also present opportunities for innovation and leadership in the financial sector.

The Path Forward

As we navigate the future of investing in South Africa, integrating sustainability and ethics into our financial decisions is not just a trend—it's a necessity. By aligning our investments with our values, we can contribute to building a more resilient, equitable, and prosperous South Africa for generations to come.

Action Step

Research one sustainable investment option available in South Africa that aligns with your values. Consider how it might fit into your long-term financial strategy.

Remember, every investment decision is an opportunity to shape the world we want to live in. By embracing sustainable investing, we're not just growing our wealth—we're investing in a better future for South Africa.